Trends Taking Over the Food & Beverage Industry in 2025

Sourdough. Dalgona coffee. Alternative proteins. Batch cooking.

Food has always seen plenty of trends – some are popular for a while (think Olympic Village chocolate muffins), while others have wider effects on consumer behaviours and eating habits. It’s impossible to predict what kind of food or drink will go viral next, but companies can give themselves better chances for medium- and long-term success if they strategize around deeper “trends” that have a longer-lasting impact.

The future of marketing in the food and beverage industry isn’t just about anticipating or taking advantage of the next Girl Dinner moment. In such a competitive landscape, companies should set themselves up with marketing strategies that are sustainable and purpose-driven. Here’s your deep dive into the top trends that will shape F&B marketing in 2025.

#1 — Gen Alpha’s Heightened Health Consciousness

All right, so Gen Alpha don’t have much spending power – yet. But their parents do, and their parents are seeing Gen Alpha growing into eco-conscious and health-focused consumers of the future.

Globally, popular culture has seen a renewed focus on personal health and wellness, both mental and physical. Thanks to breakthroughs in science and research, we know more about the human body than we’ve ever known. That’s led to bigger discussions about things like food sensitivities, macronutrients, and gut health – plus the connection between that and mental well-being.

Mintel’s research shows increased demand from Gen Alpha parents in the U.S. and U.K. for food or beverage products that support immune function and digestive health. It found that 9 in 10 parents of kids aged 4-5 were more interested in food and drink options that promoted gut health.

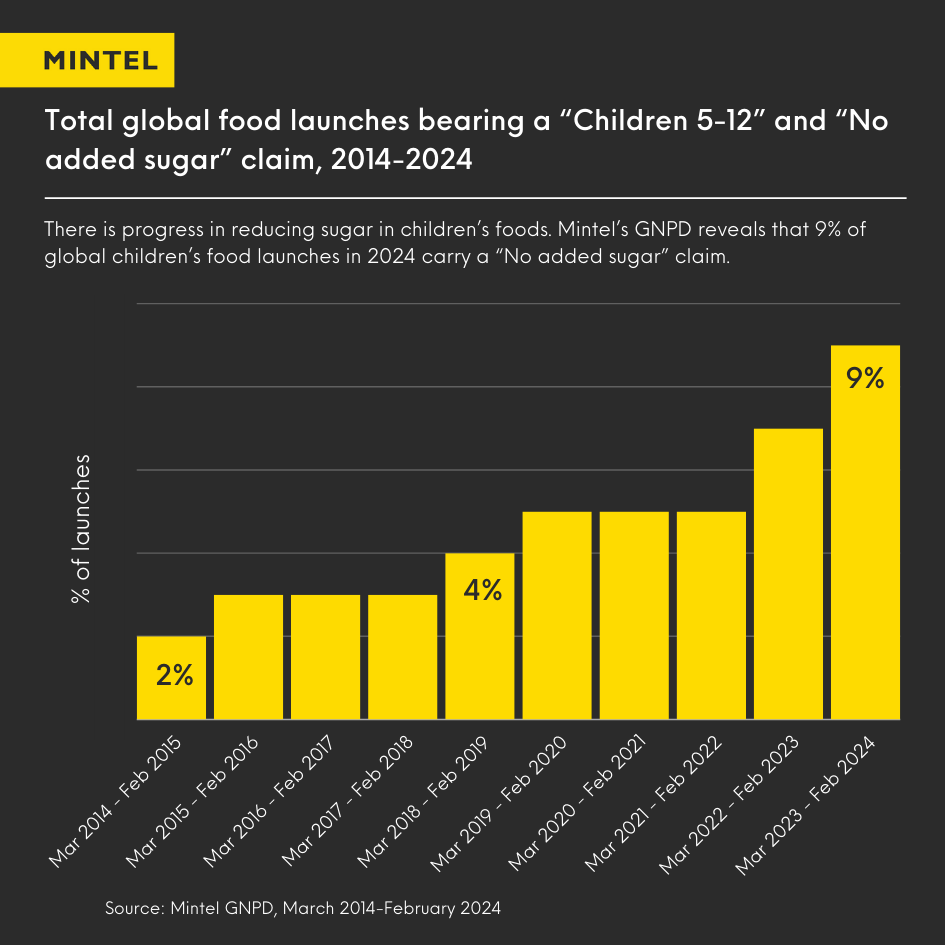

This is, in part, thanks to more media and content empowering children with knowledge about their health and nutrition. It’s also thanks to a general increase in content raising awareness of the connections between diet, physical health, and mental health. That has driven brands to innovate healthier food and beverage options that use natural – or at least less-processed – ingredients. It’s also seen an increase in companies launching foods that feature fortification claims (28% of global children’s food launches in 2024) or “no added sugar” labels (9%).

Gen Alphas are also looking more at sustainable food choices, influencing their parents to do the same. Mintel reported that 39% of U.K. parents of children aged 4-17 were prompted to reduce consumption of animal-derived products like meat and dairy. Gen Alpha’s pragmatism and eco-consciousness present food and beverage companies with an opportunity to align their products – and their marketing – with the values of the next big consumer base.

#2 — Meal Prepping and Ready-Meal Life

If you’ve watched a YouTube video, you’ve probably encountered a Hello Fresh ad.

The selling point of Hello Fresh is having pre-portioned ingredients for recipes that you can cook for yourself or your family. No need to fill up your pantry or plan meals every day of the week – Hello Fresh will give you exactly the ingredients you need, for recipes chosen beforehand. The idea is to save you time and effort while still getting the benefits of home-cooked food.

Meal kits have gotten more popular in recent years, as people become more conscious of “cleaner” eating but lack the time and energy to make full meals, 3 times a day. Takeaway and food delivery services come with higher costs, but also a certain wariness from consumers who feel they may not be very healthy. Companies like Hello Fresh, Chef’s Plate, and GoodFood offer people the option of homemade meals that match their dietary needs or preferences – without the extra stress of grocery shopping and ingredient prep.

For people who do feel comfortable buying groceries and planning lunches and dinners, another trend that’s emerged is meal prepping. The idea is to pre-plan a week’s worth of meals and prep as much as you can beforehand – such as batch-cooking parts of the meal and freezing them in pre-portioned servings. You can then heat up each serving as needed, instead of having to cook from scratch every time.

Meal prepping requires more effort, but it does give people the reassurance that they’re using ingredients they chose and cooking the food to their preferences. And no, it doesn’t mean they have to eat the same thing every day – many cooking and nutrition influencers have put out recipes and guides for how to prep diverse meal options, whether you’re cooking for yourself or a family.

But for anyone who wants to skip cooking entirely, there is a growing market for ready-made meals. These are pre-cooked meals that are frozen or otherwise shelf-stable, delivered directly to people’s homes. Clean Plates, Factor 75, and We Cook are all companies that allow you to choose specific dietary plans or meal types, which are then cooked and shipped out, ready to eat. The recipes are pre-selected on a per-day or per-week basis, and many brands let you customize your subscriptions.

At the moment, about two-thirds of people surveyed in the U.S. do not think ready-made meals are “healthy enough” for regular consumption. But with the right marketing and messaging, companies can change consumer perceptions and expectations. A company could leverage the chance to explore different cuisines, be more in control of their calories, or support sustainable nutrition.

#3 — The Sober-Curious Movement and Beverage Innovations

Alexa, play Alcohol-Free by Twice – let’s talk about the Sober Curious Movement.

Sober curiosity looks different to every person, but the general idea is for a person to more closely examine their relationship with alcohol. Sober-curious adults are pushing back against cultural expectations around drinking and the stereotype that alcohol is a “prerequisite” to fun social events.

The movement has seen individuals explore ways to consume alcohol more responsibly, whether that means drinking less or not drinking at all. It’s not always a commitment to total sobriety from the get-go – each individual has their own journey – but it allows people to be more aware of how alcohol fits into their lifestyles. And there are a variety of reasons why someone might be curious to try sobriety, whether that be alcohol disorders or personal health.

As more people become sober-curious, the beverage industry has responded with several innovations. See the rise of functional beverages, or non-alcoholic drinks that contain bioactive compounds, which are prevalent alcohol-free alternatives to cocktails.

Functional beverages aren’t new, but they’re seeing a surge in popularity and marketing. Part of the appeal has been the modernized branding, which lets beverage brands make drinks “fun” with playful or party vibes that match alcoholic drinks – without the alcohol.

Celebrities have hopped onto the trend – just look at Tom Holland and BERO. The actor has launched a line of non-alcoholic beers alongside brewmaster Grant Wood, with the promise of blends that are “intentionally lighter on alcohol but big on flavor.” Then there’s Blake Lively’s Betty Buzz sparkling drinks, which contain no alcohol or caffeine.

There are also drink lines that feature cannabis or cannabis-based ingredients to provide a fun drinking experience. High Rise, for example, offers beverages that contain THC and CBD instead of alcohol. Their drinks are also gluten-free and vegan, which aligns with young consumers looking to make healthier choices.

And, of course, you can’t leave out good old water. Many people may not enjoy drinking plain water for their own reasons, which has given rise to water additives. Flavoured and functional waters make great alternatives to pop and similar beverages – and you can buy them at the store, or make functional water yourself at home. (Perfect for that reusable water bottle!) Or try out “alternative” waters like Liquid Death, which have “fun” branding that still makes it feel like a party.

#4 — Energy, Sports Drinks, and Gaming

Sports drinks have enjoyed plenty of success since the emergence of brands like Gatorade and Powerade. They’ve long broken containment from the sports industry; people buy sports drinks for all sorts of reasons, from post-workout rehydration to dealing with the flu.

But research by Mintel has shown that sports drinks are facing some stiff competition – and it’s from functional drinks, especially energy drinks.

The market for sports drinks has largely been dominated by younger generations, primarily people aged 16-34. That same age bracket makes up a large chunk of the audience for non-traditional media personalities, such as streamers and YouTubers. And the intersection has set up a ready market for fortified energy drinks as an alternative to established sports drinks.

Take PRIME, the joint endeavour by Logan Paul and KSI. PRIME has seen notable success since its launch, thanks in large part to the marketing around it. Its biggest partner is Arsenal Football Club, one of the world’s top 20 football teams. But Paul and KSI reached new heights breaking into the e-sports and gaming niches by leveraging their own audiences while linking up with popular creators like IShowSpeed.

(All this, even if sports nutritionists have pointed out that PRIME drinks are far too caffeinated for children and aren’t necessarily “better” than regular sports drinks.)

Other gamer-focused drinks brands have seen similar success. The COVID-19 pandemic (among other things) has made people more conscious of their intake of vitamins and minerals, alongside macros like fibre. People are also more conscious of limiting their intake of sugar and calories. Companies have tapped into that underserved market of young adults who prefer to use sports or energy drinks to supplement their dietary needs.

Brands like Gamer Supps, ADVANCED.gg, and G FUEL advertise their drinks or drink mixes as having extra protein, being keto-friendly, or providing “nootropic cognitive enhancement.” They emphasize how their drinks have zero sugar or fewer calories or antioxidant ingredients. And as older generations begin taking an interest in sports nutrition for healthier ageing, it’s clear that niche has the potential to grow.

Get Your Slice of the Marketing Pie

New niches have opened up among consumers when it comes to the food and marketing industry. The common thread among these niches is a focus on personal well-being and sustainability – people want healthier, cleaner diets. Companies have a golden window to align their products and their marketing with these new expectations, though it’s not enough to just talk the talk. The products must walk the walk, too.

These trends may shape the marketing landscape in the food and beverage industry for 2025, but they could (and likely will) also change consumer behaviours for years to come. To make the most out of the different F&B trends and consumer habits, a company must foster a genuine connection with their audience. That means delivering the right message and the right product – so that, as the kids say, your company is “cooking.”

Discover what these trends could mean for your business in the food and beverage industry. Book a free marketing consultation with Kika to identify new marketing opportunities and how you can make the most of them.